WHY YOU NEED AN OBC FUNERAL PLAN?

The death of a loved one is a very traumatic time in your family’s life. The last thing you should worry about is not having money to plan a dignified funeral. The OBC Funeral Plan is your answer – it pays out cash within 24-48 hours and has other great benefits that you can add to your policy.

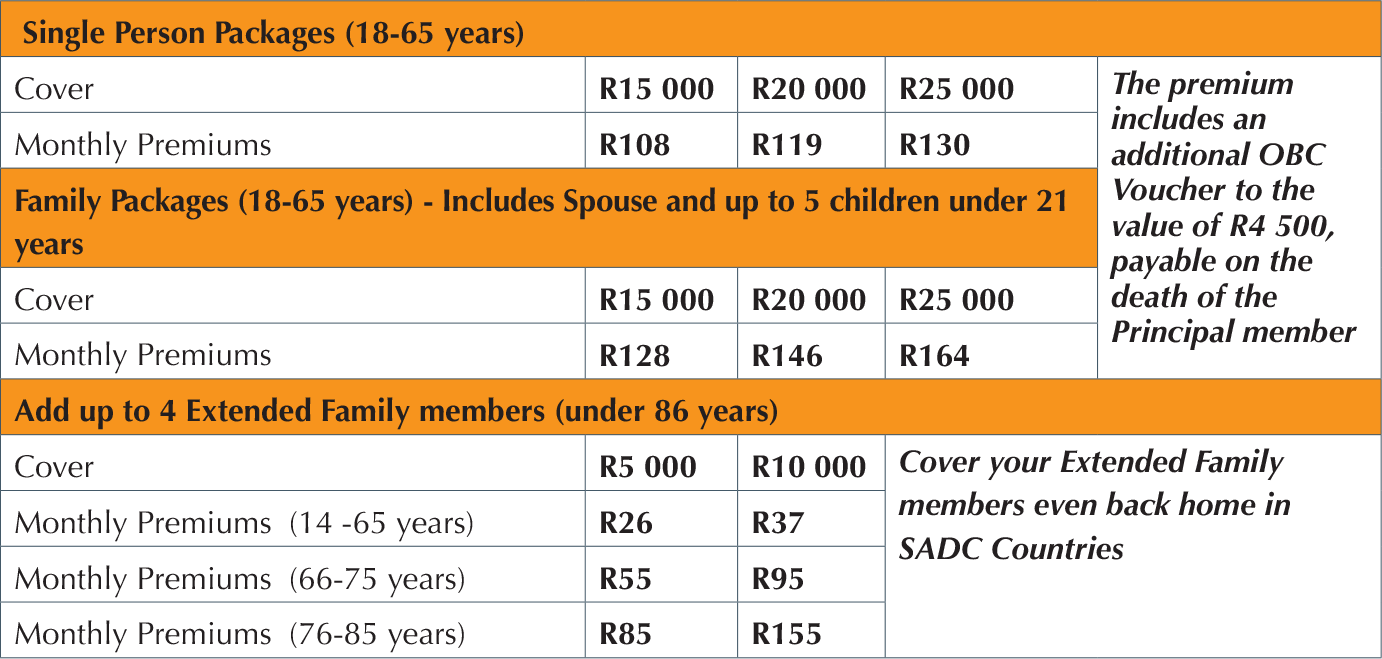

HOW MUCH DOES IT COST?

Starting from as little as R108 per month you can build your own policy to suit your specific needs and your pocket. Each additional Extended Family member and additional benefit has a small premium. You decide what you want in your policy and the monthly premium will be calculated.

KEY BENEFITS FOR THE PRINCIPAL MEMBER

- Cover of up to R25 000 for the principal member and R10 000 for extended Family members. Benefits are priced separately and the Principal member can add extended Family members to his/her policy.

- R500 cash for Airtime (on death of the Principal member only) @ R1 per month extra.

- Mourners transport for up to 12 mourners to and from the funeral within the borders of RSA (on death of the Principal member only) @ R20 per month extra.

- Repatriation to any of the SADC countries (on death of the Principal member only) @ R25 per month extra.

- Repatriation to the funeral home closest to the place of burial anywhere within the borders of RSA (for the whole family excluding extended family members).

- Telephonic legal assistance, HIV/Trauma assistance and emergency evacuation to the nearest medical facility for any medical emergency (applies to the whole family excluding extended family members) @ R10 per month extra.

- Legal assistance for 3rd party claims on a no win no fee basis e.g. Road Accident Fund claims, Medical negligence claims, slip and fall claims, dog bite claims (applies to the whole family excluding Extended family members) @ R1 per month extra.

- Take Note: the premium the principal member pays INCLUDES an OBC Voucher to the value of R4 500 payable on the death of the Principal member only. This amount will be paid into the Thola Zonke card of the nominated beneficiary to redeem at any OBC Store.

HOW TO CLAIM

- Contact the AUL Service Centre on 087 820 0049 and report the claim.

- AUL will assist you to obtain all the relevant documents e.g. death certificate, deceased ID / Passport, beneficiary ID / passport and bank details, claim form. For claims for Extended Family members back home in the SADC country, AUL will assist as to what forms will be required. On receipt of the documents the claim will be processed and if valid, paid out within 24-48 hours. The beneficiary will be kept updated on the progress of the claim.

PAYMENT OPTIONS

- You can pay your monthly premium by cash or with your OBC Thola Zonke card at any OBC Store or you can pay via debit order.

- Ensure your correct banking details are provided and please ensure you have sufficient funds in your account when your debit order is due to deduct. If your debit order fails, you can also pay cash at any OBC store to ensure you don’t lose your benefits.

FREQUENTLY ASKED QUESTIONS

- When should I buy Funeral Cover?

Many individuals prefer to postpone the purchase of any insurance until such a time that they have dependents. It is important to ask yourself if anyone will suffer financially if you were to die. If so, OBC funeral cover will protect your family from unexpected funeral costs in the event of your death.

- When does my cover begin?

Membership begins when the insurance company accepts your application form. Cover commences after the waiting period has expired.

- Should I change from one insurance company to the next, every couple of years, to save on premium?

This is not recommended. Before you decide to change from one insurer to the next, make sure you ask the important questions. Are your benefits better? Will any waiting periods apply? How do I really benefit if I decide to change? Who is the new insurer? Are they reputable and are they registered with the FSCA?

- Is there a waiting period when I cannot claim?

YES, the following waiting periods apply:

1) Natural Causes: The Principal member and his/her family have a 3 calendar month waiting period and Extended Family members have a 6 calendar month waiting period.

2) Unnatural Causes/Accidental Death: No waiting period applies. Cover commences after receipt of the 1st premium.

3) Suicide: 12 calendar month waiting period applies.

- How long does it take for my beneficiary to receive the cash pay out after I die?

Valid claims are processed and paid within 24-48 hours after receipt of all the relevant claim documents. Promptness of payment is dependent on the correct documentation being supplied.

COMPANY DETAILS

Registered Name

Registered FSP number

AUL Address

AUL Customer Services

OBC Group details

African Unity Life Ltd “AUL”

2003/016142/06

8447 Springfield Office Park, 109 Jip de Jager Drive, Bellville, Western Cape, 7530

087 820 0049 (08h00 – 16h30 weekdays)

OBC GROUP (PTY) LTD,1158 Louwlardia Drive Centurion, 1683

Tel: 0861 622 622

www.obcgroup.co.za

COMPLAINTS

If you have received inadequate information or unsatisfactory service or have complaints about the advice you have received, please contact AUL’s Compliance department at: complaints@africanunity.co.za.

Should you be unsatisfied with the complaints handling process of AUL’s Compliance Officer, you can contact the Ombudsman for Long-term Insurance using the details below.

Postal Address

FAIS Ombud

PO Box 74571

Lynwood Ridge

0040

Physical Address

Kasteel Office Park

Orange Building, 2nd Floor

Cnr of Nossib and Jochemus Street

Erasmuskloof

Pretoria

0081

Telephone

012 762 5000 / 012 470 9080

Fax

012 348 3447 / 012 470 9080

Email: info@faisombud.co.za

Website:

www.faisombud.co.za

Postal Address

Private Bag X45

Claremont

7735

Physical Address

Sunclare Building,

3rd Floor

21 Dreyer Street

Claremont

Cape Town

7700

Telephone

012 657 5000 / 0860 662 837

Fax

012 674 0951

Email: info@ombud.co.za

Website: www.ombud.co.za

TERMS & CONDITIONS APPLY

You must have a valid RSA Id document or Passport (if you are a foreign national). You must be between 18-65 years to qualify for the OBC Funeral Plan. Extended Family members must be under month on or before the 5th – either with cash using your Thola Zonke card at any OBC till point or via debit order. Your policy will lapse if you don’t pay your premiums. Waiting periods do apply as per above. If your policy lapses and you want to re-join at a later stage, waiting periods will apply unless the insurance company is prepared to waive the waiting period. Claims will only be paid into a valid RSA bank account. The OBC Voucher to the value of R4 500 (only applicable on the death of the Principal member) will be paid into your Thola Zonke card which your beneficiary can redeem at any OBC Store. You will receive a policy schedule within 48 hours of signing up for the OBC Funeral Plan. Underwritten by African Unity Life Limited, a registered insurer and authorised financial services provider FSP 8447.

HEAD OFFICE

0861 622 622

CUSTOMER CARE

OBC Customer Care

0861 622 622

complaints@obcgroup.co.za

Monday To Friday

08H00 – 17H00

FIND OUT MORE

Copyright © 2020 OBC Group. All Rights Reserved.